Refinancing solutions

Refinancing solutions for your financial needs

At TIC Advisory, we understand the complexity of financing and the importance of finding the right solutions for your business. Refinancing plays a crucial role in optimizing your financial structure and ensuring long-term sustainability.

Our approach:

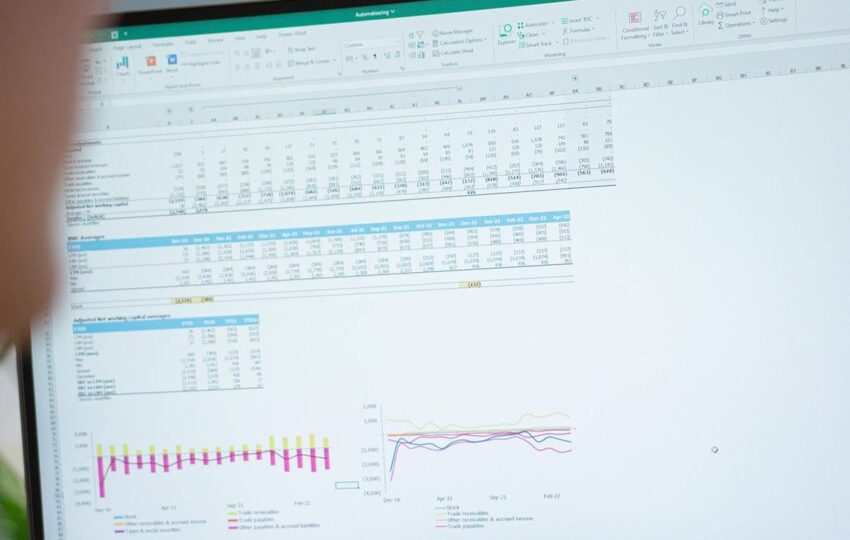

- Comprehensive financial assessment: We start with a thorough evaluation of your current financial position, including existing loans, interest rates, and cash flow. This assessment provides a clear understanding of your financing needs.

- Tailored refinancing strategies: Based on the assessment, we develop personalized refinancing strategies that align with your business objectives. These strategies may involve renegotiating terms, securing new loans, or exploring alternative financing options.

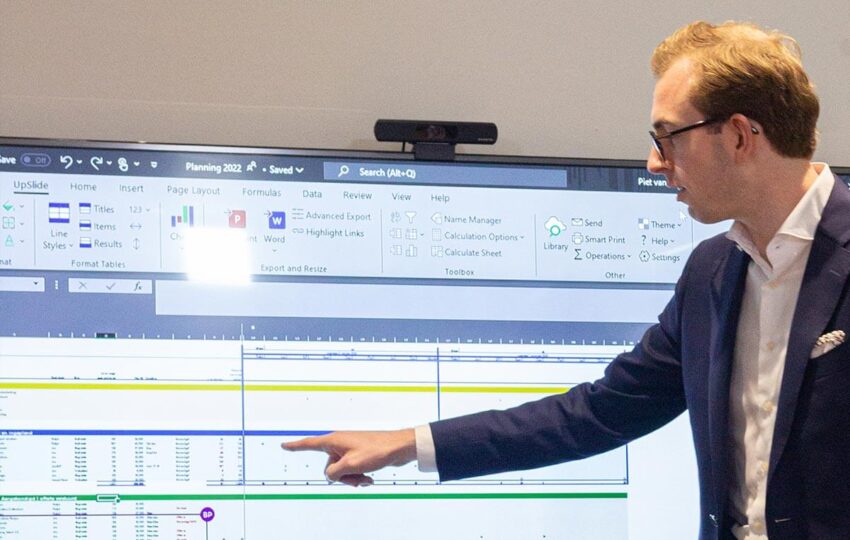

- Expert guidance: Our team of experienced financial advisors and analysts will guide you through every step of the refinancing process. We work closely with your business to ensure that the chosen refinancing solution is the right fit.

Your benefits:

- Improved financial structure: Refinancing can lead to better terms, reduced interest rates, and improved cash flow, which can enhance your financial stability.

- Cost savings: By optimizing your financing, you can potentially reduce borrowing costs and increase profitability.

- Tailored solutions: We understand that each business is unique. Our refinancing solutions are customized to meet your specific needs and financial goals.

- Expertise: Benefit from the expertise of our financial professionals who have a deep understanding of refinancing options.

At TIC Advisory, we have a proven track record of helping businesses navigate complex financing issues through refinancing. Whether you are looking to lower your borrowing costs, restructure your debt, or explore alternative financing, we have the expertise to assist you.

Contact us today to discuss your refinancing needs and discover how we can help you achieve your financial objectives.